Credit card foreign transaction fees

What are foreign transaction fees and how can I avoid them?

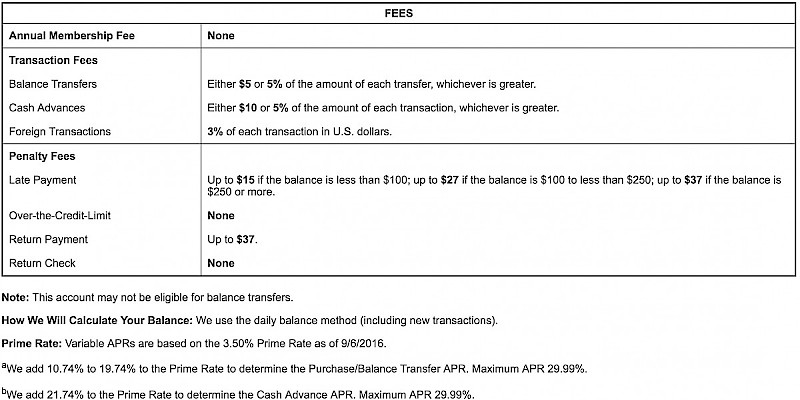

While paying with credit cards does get you a better exchange rate than with cash, know that Visa itself imposes a 1% "commission" for foreign purchases/cash advances.

Many Visa-issuing banks—recognizing yet another good way to fleece its own customers—tack on additional 1%, 2%, or even 3% "commissions" of their own.

They will tell you this is a banking fee for performing the currency exchange.

They are lying.

This is because:

- The Visa corp has already performed the currency exchange before the transaction ever gets to your issuing bank (which receives the transaction in dollars), and

- It's all electronic, so there's really nothing to "exchange" in the first place.

These extra few percentage points your bank is charging is 100% profit for them, pure and simple, and they are stealing it from you.

Luckily, there is a way around this: a low-fee credit card.

- Findabetterbank.com - Site to find credit unions and other local banks. These often have low or no foreign transaction fees on their credit cards and ATM fee–refund policies.

- Capitalone.com - Offers cards with no foreign transaction fee, and chip-and-signature enabled (making it easier to use in Europe).

- Bankofamerica.com - Offers cards with no foreign transaction fee, and chip-and-signature enabled (making it easier to use in Europe).

- Madfientist.cardratings.com - Good simple search engine to find travel-worthy cards, from no foreign fees to the ones with the best points.

- Ally.com - Online-only bank (and the one I use), with ATM feee refunds and no foreign transaction fees. Sadly, no credit cards (yet)—though you can use your MasterCard-branded bank card as a debit card.

- Usaa.com - Online-only bank open to current and former U.S. military personnel and their families; ATM fee refunds, and credit cards with only 1% foreign transaction fees.

- Schwab.com - This famous brokerage firm also offers online-only checking and savings accounts with ATM fee refunds.

- Asmarterchoice.org - Credit union–finding site. Credit unions often have low or no foreign trasnaction fees on their credit cards, ATM fee–refund policies, very few fees, and interest-bearing checking accounts. In other words: What a bank should be.

- Findabetterbank.com - Site to find credit unions and other local banks. These often have low or no foreign transaction fees on their credit cards and ATM fee–refund policies.

- Ncua.gov - All about credit unions.

- Credituniondb.com - Bare-bones credit union-finding database.